How Do You Get Money For Your Startup?

What do you do when your business venture needs money?

Maybe you have an amazing idea, and you need funds to make it take off. Or you already have a business, it’s made some good money, and you want to scale and grow it.

As a founder and entrepreneur, when it’s time to take your business to the next level, money will likely be your biggest obstacle. And if you don’t have it – you’ll need to find it somewhere.

Knowing where and how to find the money you need isn’t easy, though. You could seek out a loan, you could ask friends and family for money, or you could look into options like angel investors or venture capital.

Why Friends, Family, And Banks Are Bad For Cash Injections

You likely already know that asking friends and family for money is risky. Not only can it compromise relationships, but it can also put you in an awkward position. For example, asking for money or owing debt is never fun with family and friends. And if things don’t pan out, it could ruin a perfectly good relationship.

Similarly, if you’ve looked at traditional loans, you likely know most banks typically won’t even glance at a startup until it has stronger numbers. That means if your business or idea is relatively new – banks won’t bite. And even if you have reasonable projections, a decent track record, and a viable business, banks are still risk-averse. And in the off chance, they do consider lending you money, it’s likely the terms may cost you in the long run.

With family and bank loans gone as an option, there are two other funding choices you should consider. These two options are angel investors and venture capital (VC) funding. Today we’ll cover the ins and outs of angel investors and tell you the difference between angel funding and venture capital funding so you can make the best choice moving forward.

When Angel Investors Are A Great Option

For startups and new businesses, angel investors can be a great option. While banks are very risk-averse, angel investors tend to be entrepreneurs who have taken risks and have enough money to take a chance on the potential of your business regardless if it’s tech, e-commerce, or a UK online casino portal oriented to a B2C audience.

Unlike a bank, you won’t have to use your home or personal assets as collateral, and even if your business is new, there are angel investors who will take a risk on your idea. For startups, especially those that are in the early stages of development, this is all excellent news.

Angel investors are typically adamant in playing a role in the development of your business. If you scout out the right angel investor, this could mean you get the help of a savvy entrepreneur who catapults your venture faster than if you did it alone. For startups seeking a cash injection, extra hands, and support, this can be help speed up growth and get you mentoring to boot.

It may sound like we’re promoting angel investing as the end-all for every startup, but let’s make sure to touch on the potential cons of angel investors.

The Trade-Off With Angel Investors

To get something, you must be willing to give something back.

Since Angel Investors are funding and risking their hard-earned money on your startup, they’re going to ask for a few things in return. One of the big things angels want for their risk will be part ownership of your business.

In return for betting on you and your venture, angels want a piece of your business.

According to most data, Angel Investors typically take 20%-25% ownership of your business. This isn’t entirely bad, though. In fact, Angel Investors taking partial ownership can be good because it means your success will directly impact the return of investment and success of the angel.

With the money you accept, you’ll agree that this investor now has some say in how your company operates. Again, if you carefully choose an Angel Investor who is a great fit – it can play in your favor to have someone else who’s a seasoned professional partake in your business decisions.

Who Are Angel Investors?

Before we dive deeper into angel investors, let’s look at what it takes to be an angel.

When you have someone who’s been carefully vetted, you’ll be assured they can invest and help your venture for the long term.

Angel investors usually are individuals who have gained an “accredited investor” status. Of course, this isn’t always required, but it’s good to know that angel investors are people who have been qualified and understand how to handle their money. The Securities and Exchange Commission (SEC) defines an “accredited investor” as one with a net worth of $1M in assets or more (not including personal residences). And this person has also earned $200k in income for the previous two years or has a combined income of $300k for married couples.

As someone seeking funding, this matters to you because you want investments from people who have enough money to invest. Similarly, you want someone who has enough income not to go crazy if they’re not paid back within a year, two, or many years down the line.

Another thing that is important to note here, angel investors are typically interested in the longer game. Most angels are interested in helping see the company through its early stages and onto its future success.

Before you jump ahead to the section of where to find angel investors, here are few quick notes on how to spot and qualify a great angel investor:

- The angel has an income that exceeds $100,000 (the more, the better).

- The angel is 40 to 60 years old (being older will help assure they’ve already made other investments).

- Has a net worth above $1,000,000 (this means they have an expendable income and won’t get anxious if the money takes time to earn back).

- Has previous successful entrepreneurial experience (remember this person is going to be a co-owner of your business).

- Expects and is ok holding the investment for up to five to seven years (although some angels wish to “cash-out” after only a few years).

- Enjoys advising and likes to be part of the action (again, this person is a co-owner, so they will most likely want to advise).

- Is willing to be a co-owner of your business and will work as a strong ally in your future success.

- Invests up to $150,000 but may participate with other angel investors so more money can be added to ventures (plays well with others).

- Refers deals to other private investors even if the angel has chosen not to invest (it’s good to have someone with connections and who is generous).

- Likes to invest in an industry with which the angel is familiar (if you can, get someone who knows your industry well). Sources deals through referrals (investors who show forethought will bode well for your future together).

These are just a few notes, but our best advice is to reach out to us. By having our personal assistance, we can make sure you find the right investors and get terms that help you the most.

Venture Capital vs. Angel Investors

Now that we’ve covered the pros, cons, and upsides of angel investors – let’s look at who and when it’s a good idea to seek an angel investor.

When you’re a new startup, or you’ve been around for a bit but haven’t sunk your teeth into a market – angel investing can significantly benefit your business.

On the other hand, if your business has been around for a while and has reliable projections/data points, an angel won’t be your best match. In the case where you need millions in funding, a venture capitalist will be the better choice. Of course, in return for more money, you will give up more stake in your business (which means a dilution of ownership).

When you need mentoring, associations, access, and a cash injection of a few hundred thousand dollars or less – an angel is the right choice. According to the Small Business Association, angels typically give out upwards of $300,000, and venture capitalists give an average of 11.7 Million dollars. Noting these figures makes it apparent, angels are great for startups with less history and fewer data points to show profits and losses. As a startup, this means angels can be a great resource. However, if you need millions of dollars to develop, scale, and grow, then you’ll want to seek out venture capitalists.

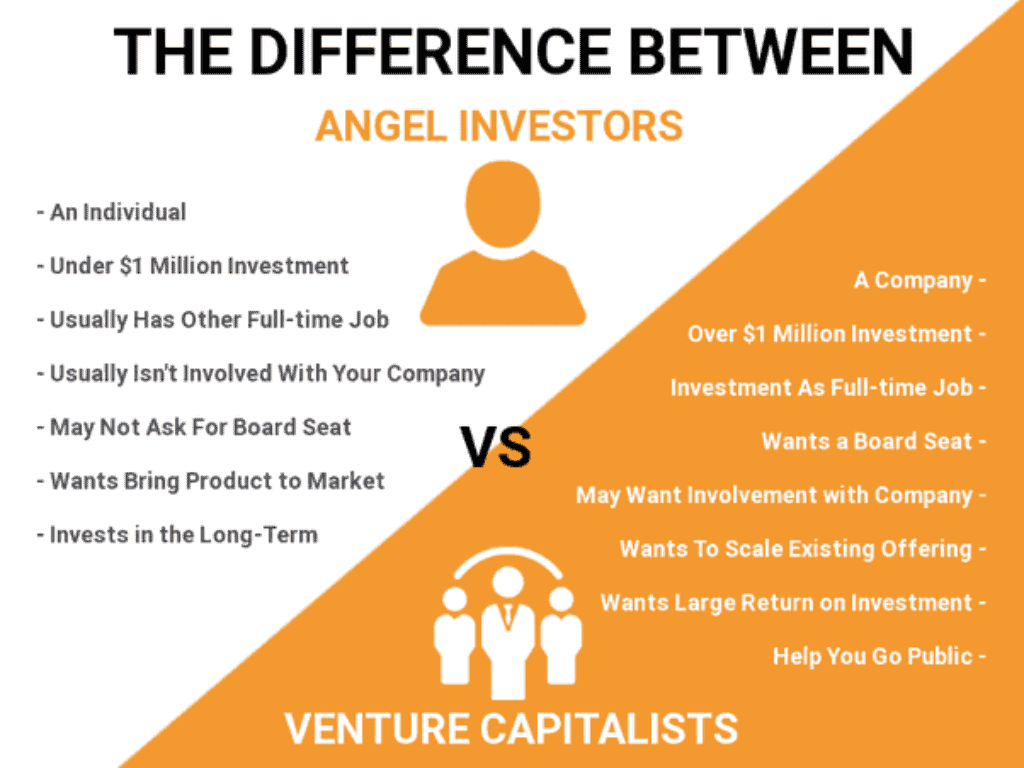

To help you visually understand the differences between a venture capitalist and an angel, here is a good image. Notice that angels give less money, take less stake of the business, and also note we’ve previously mentioned that angels will play a more active role in mentoring and helping the business grow.

How To Find And Meet Angel Investors

Now that you’ve read this far, it’s likely you’re wondering:

“Where do I find my magical angel investor?”

Well, before we dive into how and where to find angels, let us give you one big caveat to this whole process.

Before you go pitch an angel, do your homework.

While the thought of having someone give you access to resources, cash, and mentoring is quite appealing, it comes at a cost. Before you sign any contracts or court an angel, realize that you’re giving up a stake in your business. On top of that, you’re welcoming someone into your business and life in a personal way.

Choosing wisely can help you, and choosing poorly can hurt your business. Among all the success stories, there are spotted histories of bad matchups among angels and startups. We don’t say this to scare you, but instead, to encourage you to seek wise counsel before you sign any contracts.

Our best advice is to get help finding and working with an angel investor upfront. Give us a call. We’ll help you tap into the best angel investor communities, and we’ll help you through the process, so you create the best contracts and agreements. Do this part right, and you won’t dilute your ownership. You’ll get a great investor, and you’ll get terms that are amicable to your future.

All that being said, here are some resources to find angel investors:

Our Specially Curated List:

Since we pride ourselves on creating partnerships, we’ve made our own list. Unlike most lists online, this one is updated and carefully made for you.

AngelList:

This resource allows you to network, meet, and read the profiles of other angels as well as that of other startups. With regular emails and opportunities to get into the angel community, this a reliable resource.

The Super-Hub Angel Directory:

This resource list outlines just about every angel directory your heart could desire. Although some of the links are outdated and don’t work, this resource can still be useful in helping you find angel networks.

Angel Investment Network:

This resource offers you a chance to put up a profile, chat with investors, and connect with angels who are looking to invest. While we don’t personally have experience with this resource, we suggest you at least take a look.

Angel Capital Association:

This resource is well-known online and among investors in the community. Give this place a look.

Extra Tips & Tricks To Finding Your Perfect Angel Investor

Finding an angel is no easy feat.

Trust us. We’ve been at this for a long time!

Asking for money isn’t easy. Finding the perfect match for investors and startup is critical to your success.

Setting yourself for success and doing your due diligence in this process will be a tremendous asset to getting funded.

Here are some of our best tips to help you find the perfect angel for you:

- Reach out to experts who are well tapped into the community (speaking with us is a great start)

- Be patient. Do your homework; time is on your side.

- Network. Network. Network. Finding the perfect match is about knowing the right people. Even if someone says no, be kind, and see if they’ll make an introduction.

- Think of your future as a co-owner. Do your homework before you sign any contracts.

- Attend events and get into the community. There’s someone who wants what you have, be willing to give it time.

Wrap Up:

Finding an investor can help your business take off faster. For startups and new ventures, angel investors are a great option. By doing your homework, and following our suggestions, you can get funding that meets your terms and help you get ahead faster.